Real estate Debt investing Your way

Start your real estate portfolio with just $10 by investing in Loans, short-term, property-backed loans to home builders and renovators.

Unlock Safer Real Estate Investing

Over $2.2 billion has been invested through the Groundfloor platform. Each investment is secured by real property, not stock market trends. If a borrower defaults, we can claim the asset on your behalf—protection you won’t get with stocks, bonds, or crypto.

*Groundfloor can foreclose on properties to settle unpaid loans in case of default.

More Control

Than REITs

REITs pool your money into managed property portfolios you don’t control. Unlike crowdfunding, we originate, underwrite, and manage each loan in-house for more control and transparency.

- Earn passive income without tenants or upkeep

- Invest in underwritten, asset-managed loans

- Backed by real homes with first-lien protection*

- Open to all investors, not just wealthy

Built for Everyday Investors

Loans are the foundation of Groundfloor, providing everyday investors with the transparency and control typically reserved for the wealthy. Join 250,000+ users funding real estate in just four steps.

-

Open a free account and link your bank

-

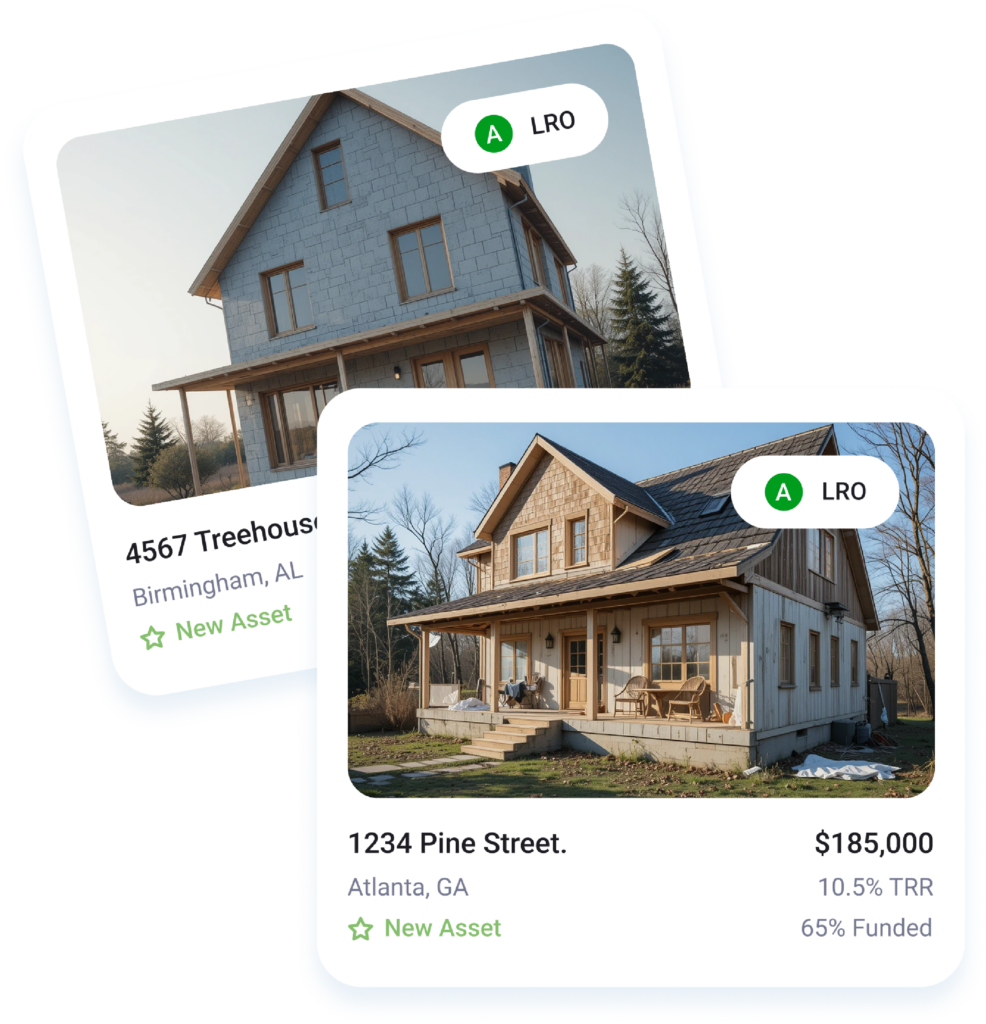

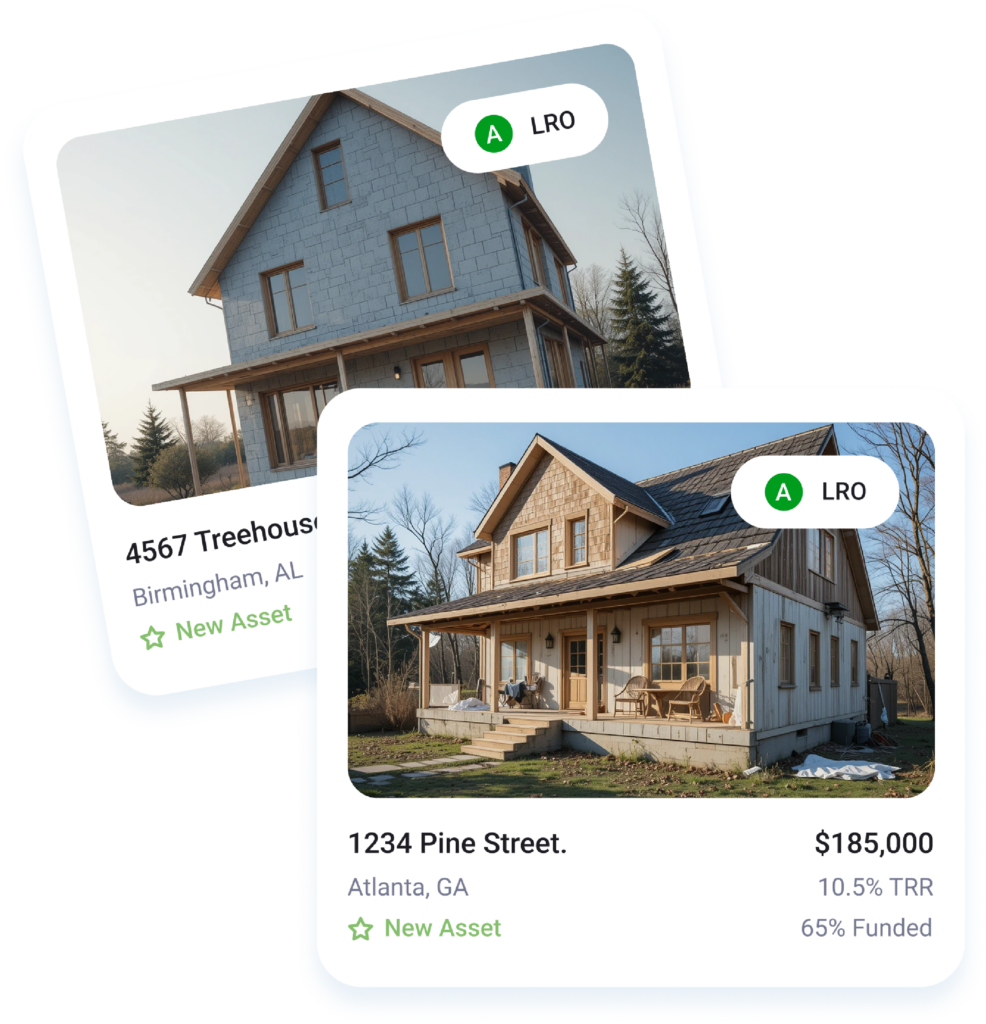

Browse properties with photos and loan details

-

Invest in projects starting at $10

-

Get paid as loans are repaid

Are Loans the Right Choice for You?

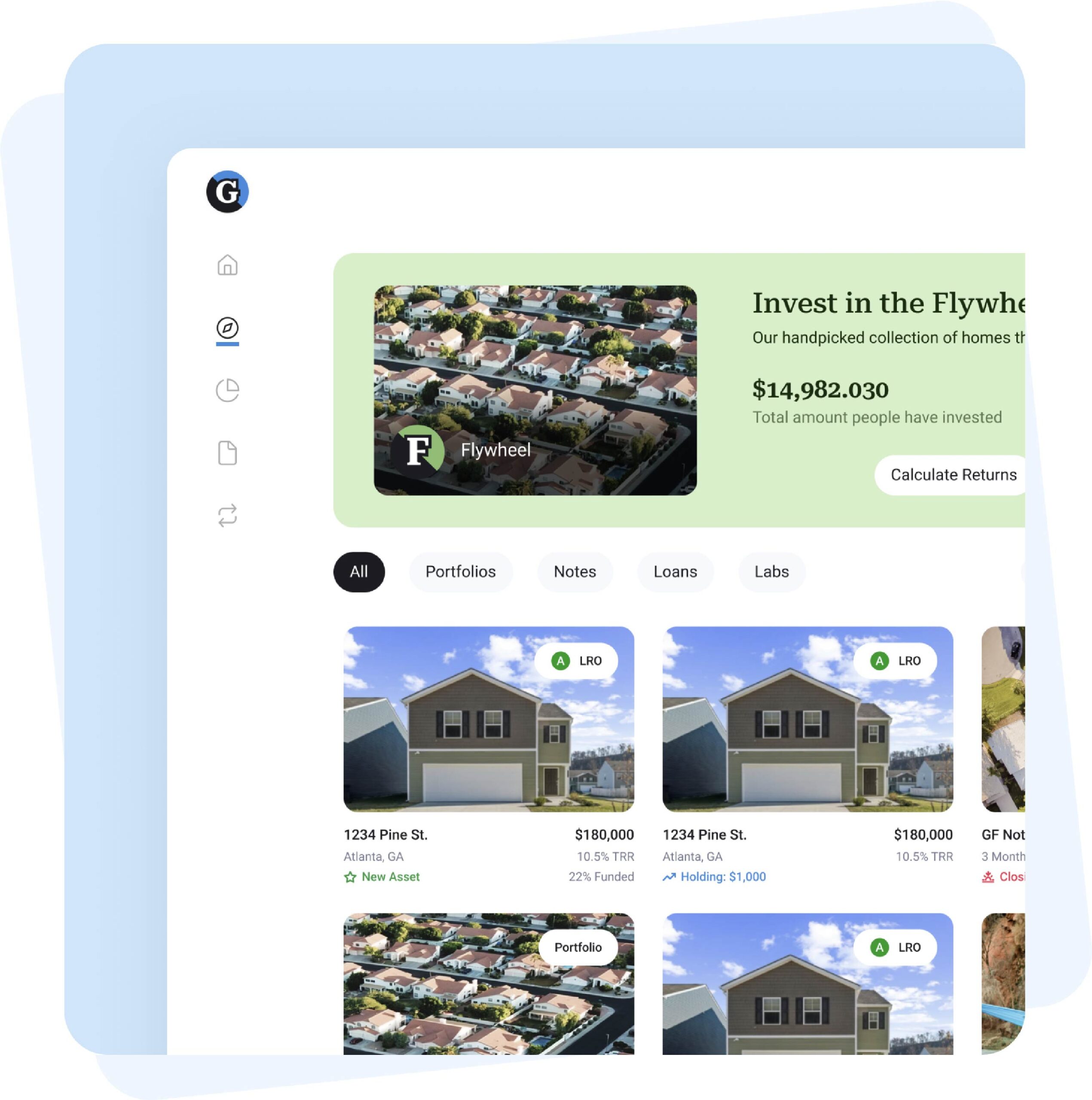

Select individual Loans or opt for our most popular option, the Groundfloor Flywheel Portfolio. It’s a smart, beginner-friendly way to diversify and grow your wealth.

Loans

Ideal for hands-on investors who want control—browse projects, review property details, and fund loans starting at just $10.

Are Loans the Right Choice for You?

Select individual Loans or opt for our most popular option, the Groundfloor Flywheel Portfolio. It’s a smart, beginner-friendly way to diversify and grow your wealth.

Flywheel Portfolio

Great for beginners and pros—your money is automatically diversified across real estate loans with zero guesswork. Start with $100.

- Invest with instant diversification in vetted real estate loans.

- Grow your portfolio with a hands-off approach.

- Start with just $100 and build wealth over time.

Take Your Financial

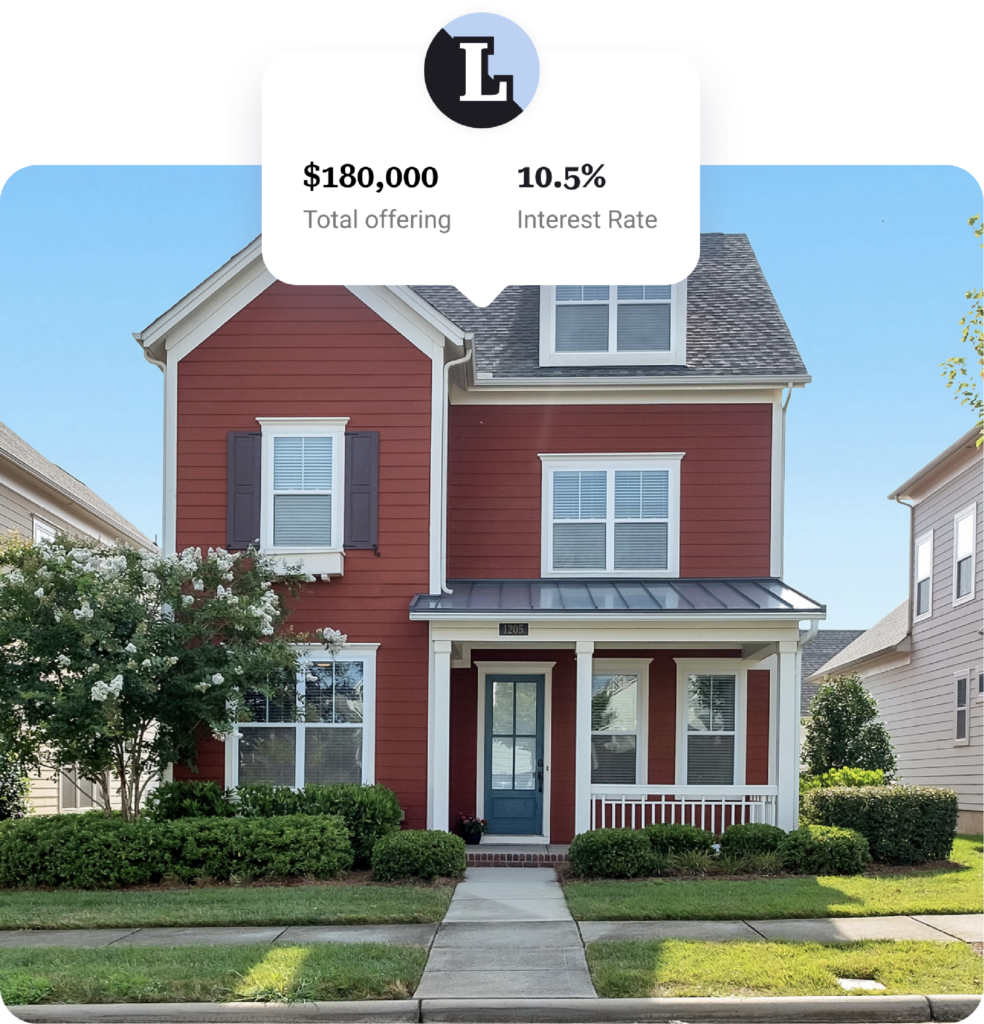

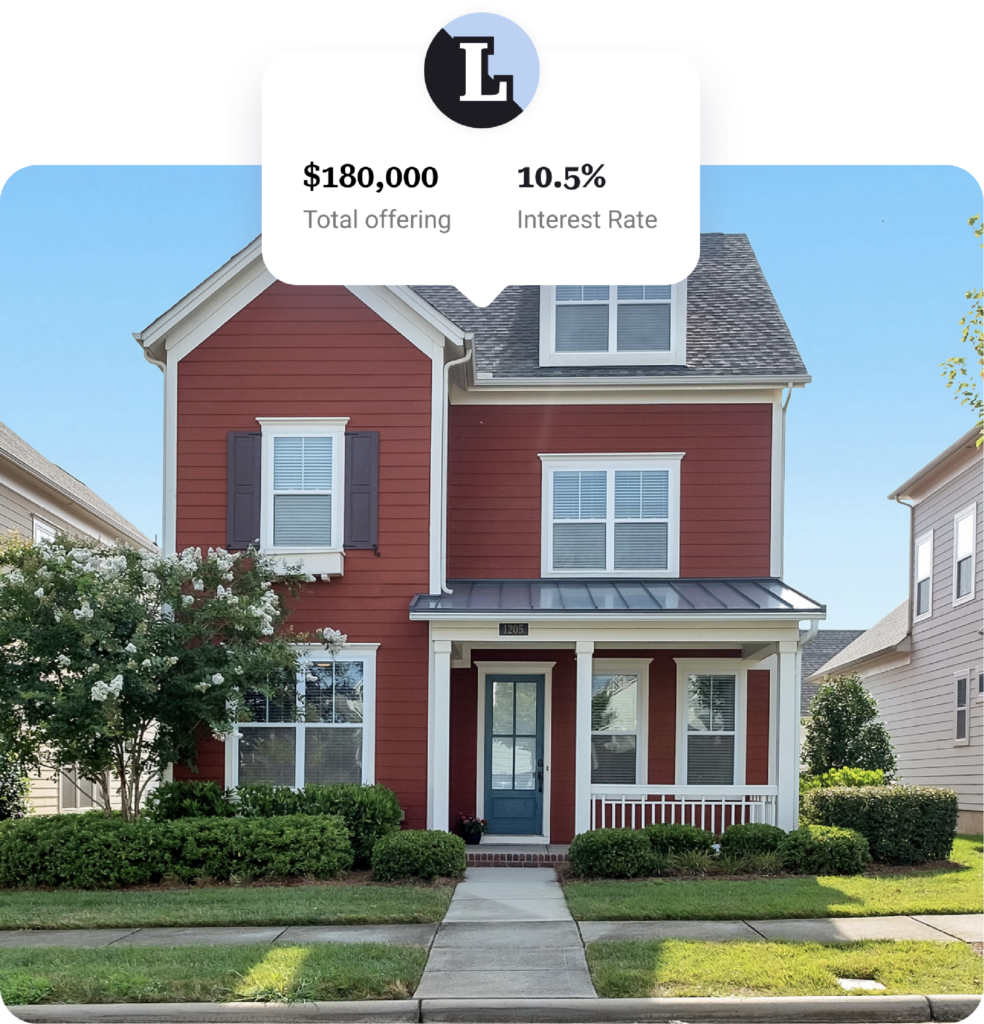

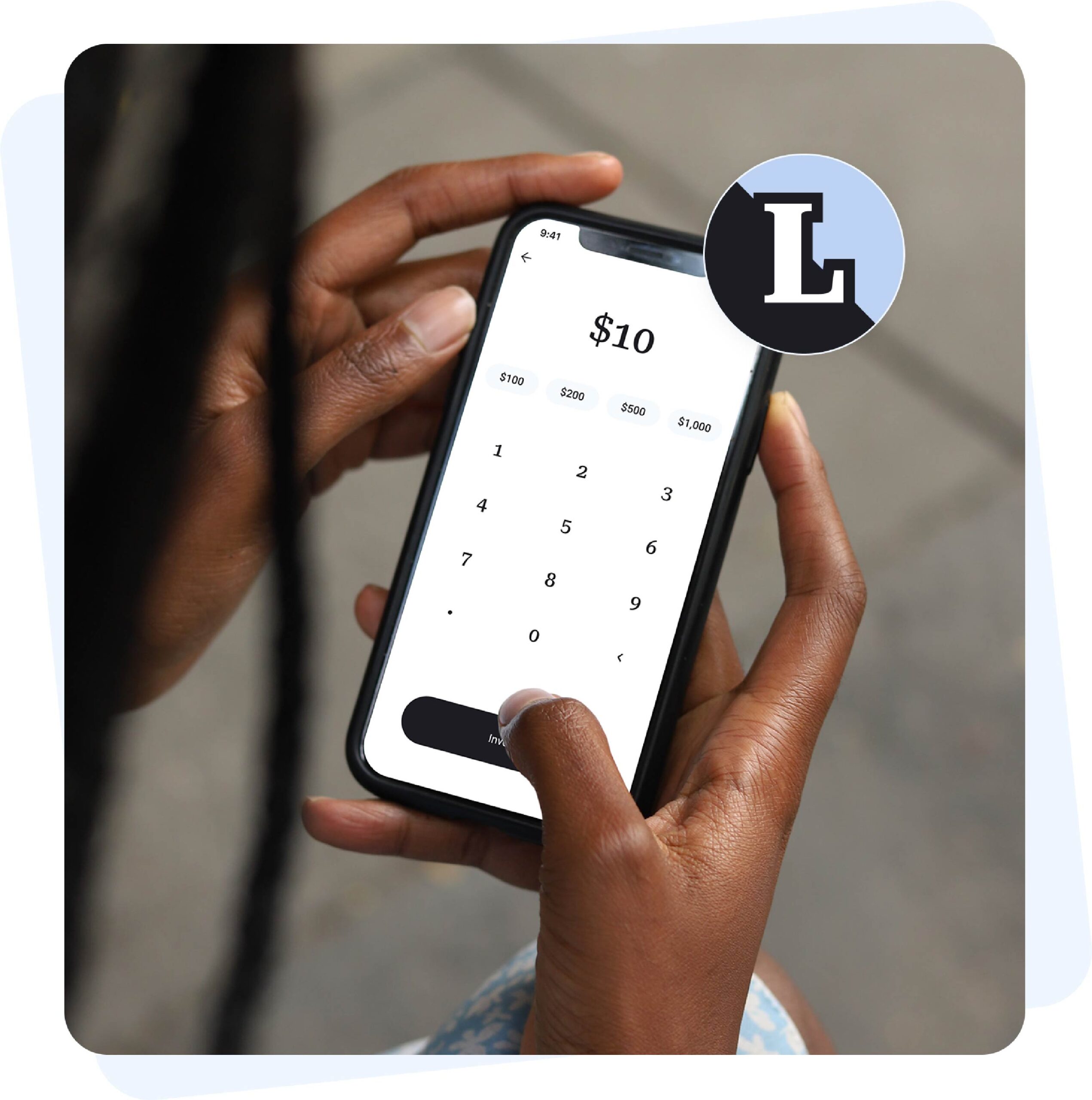

Future with You

Our app puts the power of real estate lending in your pocket. Check your portfolio, track payments, and watch your money fund actual renovation projects—all while on the go.

Start small, think big. Join over 250,000 investors who've discovered a more rewarding way to put their money to work.

Frequently Asked Questions

What exactly am I investing in?

Groundfloor lets you invest in individual real estate loans, structured legally as a Limited Resource Obligation (LRO). An LRO is a security backed by a single real estate loan.

When will I see returns?

Once the borrower repays. This could be in a few months or longer depending on the loan’s term and performance. Payments are made as loans mature.

What are the risks of investing in individual loans?

Like all investments, investing in individual loans carries some risk. If a borrower defaults, your return may be delayed or reduced.

How do these loans compare to the Flywheel Portfolio?

With loans, you have control over which assets you invest in, though it requires more time and effort. The Flywheel offers a hands-off approach, spreading funds across many loans automatically.

When are new loans released?

Every Wednesday at noon EST. You’ll receive an email on Tuesdays letting you know of upcoming releases and an email on Wednesdays once they’re available.