Real Estate Investing With Your IRA

Regular IRAs Fall Short

Most retirement accounts are market-dependent. With Groundfloor, your IRA backs real estate debt supported by actual properties.

- Returns vary depending on investor selections

- Decide exactly where your money goes

- Invest with built-in property-backed security

*Actual returns vary by loan and are not guaranteed. Past performance does not guarantee future results.

Smarter Retirement Starts with Real Estate Loans

Tax-advantaged accounts help you save. Real estate loans help you grow. Combine both for a retirement strategy built for today’s economy.

Traditional IRA

It allows you to invest earned income with potential tax deductions and tax-deferred growth.

Roth IRA

You pay taxes upfront, so contributions grow and are withdrawn tax-free in retirement.

SEP IRA

A simple way for business owners and freelancers to contribute and save more for retirement.

Simple IRA

A tax-advantaged retirement plan where both employers and employees can contribute,

Three Easy Steps to a Better Retirement

Earn more with your IRA. Getting started with Groundfloor takes just minutes.

*$25,000 Minimum Opening Balance

-

Open your account: Choose your IRA type and complete a short form.

-

Add money: Transfer from an existing account or contribute new money.

-

Start investing: Select real estate loans and begin earning potential returns*.

*Actual returns vary by loan and are not guaranteed. Past performance does not guarantee future results.

Take Your Financial

Future with You

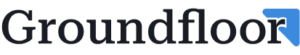

Our app puts the power of real estate lending in your pocket. Check your portfolio, track payments, and watch your money fund actual renovation projects—all while on the go.

Start small, think big. Join over 280,000 investors who've discovered a more rewarding way to put their money to work.

Frequently Asked Questions

How do I open a Groundfloor IRA account?

What is the minimum transfer amount into my Groundfloor IRA?

For new Groundfloor IRA accounts, there is an initial minimum transfer of $25,000. For existing ones, there is a minimum transfer of $1,000.

What IRA account options are available?

For new Groundfloor IRA accounts, there is an initial minimum transfer of $25,000. For existing ones, there is a minimum transfer of $1,000.

Are there fees associated with a Groundfloor IRA account?

Currently, Groundfloor is covering all custodial fees through December 2026. We’ll let you know with at least a 90 days notice if or when we issue fees beyond then.

Can I invest in the Flywheel Portfolio in my IRA?

Yes, you can invest in the Flywheel Portfolio via your Groundfloor IRA.