Why Invest with Groundfloor

For over 12 years, Groundfloor has made private market investing more accessible, giving everyday investors the opportunity to build wealth through real estate.

Our mission is simple: remove barriers, offer transparency, and put more control in your hands. We're SEC-regulated, founder-led, and supported by a growing community of over 270,000 investors who fund real renovation projects across the country.

Built for Investors, Not Institutions

Most investment platforms are designed for high-net-worth individuals, accredited investors, or financial advisors. Groundfloor is different. We make it easy to earn passive income with no middlemen or high minimums.

Hassle Free Real Estate Investing

Groundfloor gives you access to real estate-backed returns without the need to buy, renovate, or manage property. Your profit comes from borrowers repaying real estate loans that are secured by physical assets and reviewed through a meticulous underwriting process.

- Short-term investments with clear end dates

- Limited exposure to market-driven volatility

- Returns that have historically outperformed savings accounts

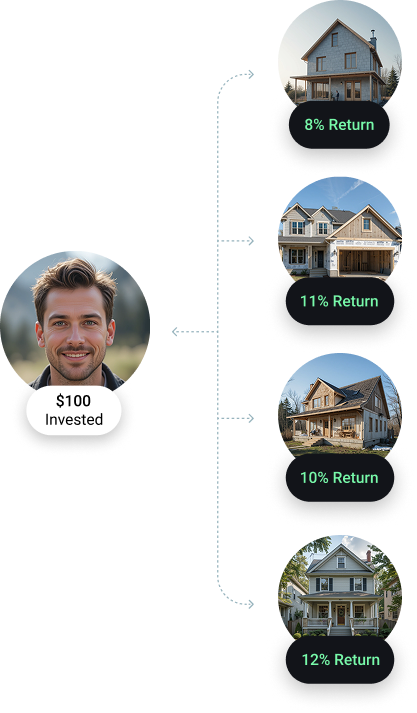

Instant Diversification in One Step

Build a smarter, more resilient future.

With one click, Groundfloor’s Flywheel Portfolio automatically diversifies your investment across a curated mix of real estate debt. That way, no single loan can define your outcomes.

Each investment is secured by real property, offering something tangible in an increasingly digital world. When you invest with Groundfloor, you're helping fund real homes while protecting your financial future.

Start building a more resilient portfolio today..

Start diversifying on your terms.

The Easy Path to Higher Yields

Four Steps to Start Earning Better Returns:

-

Create your free account and connect your bank securely.

-

Transfer funds—they’ll reach your account in 3-5 business days.

-

Your money automatically funds loans backed by real properties.

-

Receive regular payments as borrowers repay their loans.

Select the Best Investment Product for You

Explore a range of options tailored to your timeline, risk tolerance, and return goals.

Flywheel Portfolio

Groundfloor’s Flywheel Portfolio spreads your investment across real estate debt with one click, so no single loan drags down your returns. Each is backed by real property for tangible security.

LROs (Limited Recourse Obligations)

Prefer more control? With real estate debt loans (LROs), you handpick each loan, browse projects, view property photos, and choose where your money goes. Start with just $10.

Notes

Your "savings account alternative" with 30-day, 90-day, or 12-month terms. Predictable returns with set repayment dates and a $1,000 minimum

IRA Investing

Power up your retirement with real estate loans, diversifying beyond stocks and bonds while potentially boosting your long-term growth. $25,000 minimum.

Real estate investing, wherever you are.

Download the Groundfloor App

With the Groundfloor app, you can manage your portfolio, track payments, and see your money funding real renovation projects all from the palm of your hand.

It’s never been easier to start small and build toward something bigger. Join thousands of others using Groundfloor to earn passive income through alternative investments.

*10.27% return on Flywheel is calculated by weighting the loans in the portfolio by total dollar amount the REIT has invested in each loan, and taking the weighted average interest rate of all loans within the REIT portfolio. Prior performance is not an indicator of future performance and the figures provided are not intended and should not be viewed to be applicable to or to reference any potential returns that may follow any potential investment in future investments such as Groundfloor Loans 2.

Frequently Asked Questions

Is Groundfloor a REIT or something different?

Groundfloor is not a REIT. With Groundfloor, you earn interest by funding short-term real estate-backed loans. You do not own equity in properties, and your returns are tied to borrower repayments, not market value.

Can I earn passive income from real estate without owning property?

Yes. Groundfloor gives you access to short-term investments secured by physical real estate. You earn interest as borrowers repay their loans, with no property ownership required.

Is Groundfloor a peer-to-peer lending platform?

No. Groundfloor is not peer-to-peer. You are not lending directly to borrowers. Instead, you invest in real estate-backed securities qualified by the SEC and underwritten by Groundfloor.

What makes real estate debt a strong alternative investment?

Real estate debt offers predictable, short-term income backed by tangible assets. It’s not tied to stock market swings, and returns are generated by fixed loan terms and repayment schedules.

What happens if a borrower doesn’t repay?

If a borrower defaults, Groundfloor begins a resolution process. Because each loan is secured by property, the asset can be recovered and sold to help repay investors. Recovery timelines and outcomes may vary.

Can I use Groundfloor in a retirement account?

Yes. Groundfloor supports IRA investing through a third-party custodian. This lets you grow tax-advantaged income through real estate-backed offerings. A minimum balance of $25,000 may apply.