The path to private market performance

The path to private market performance

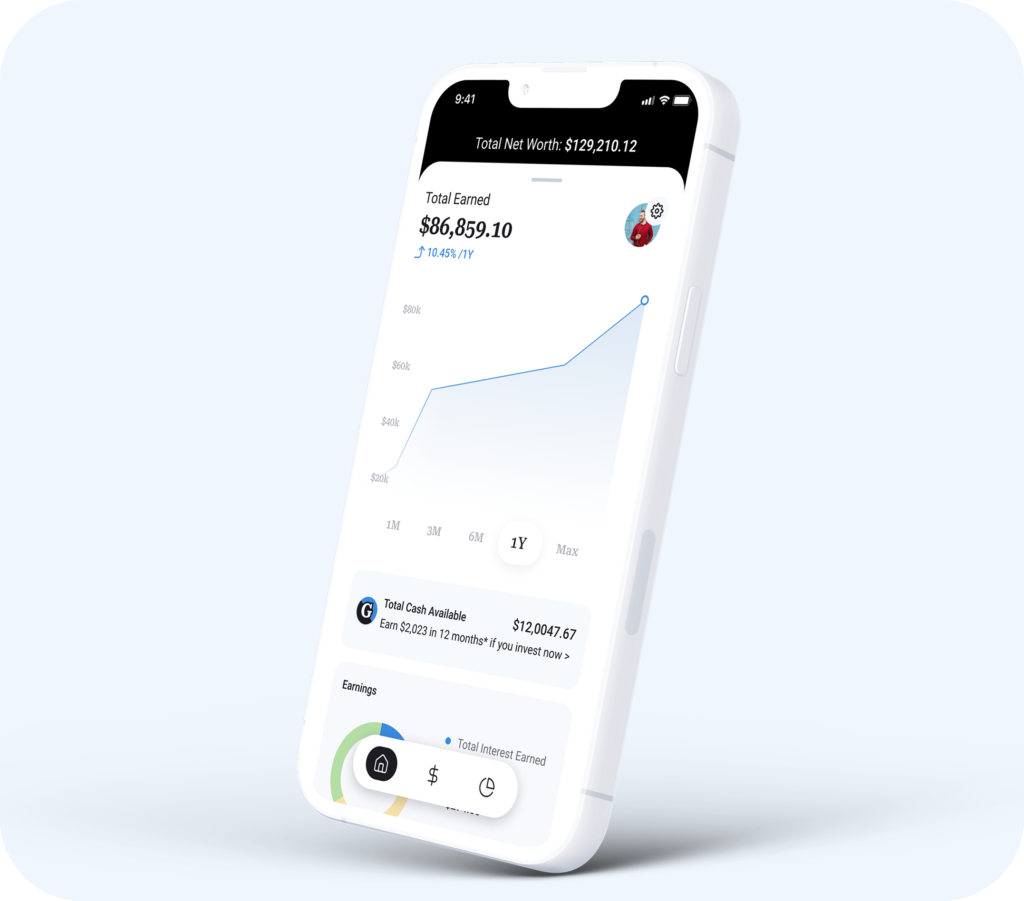

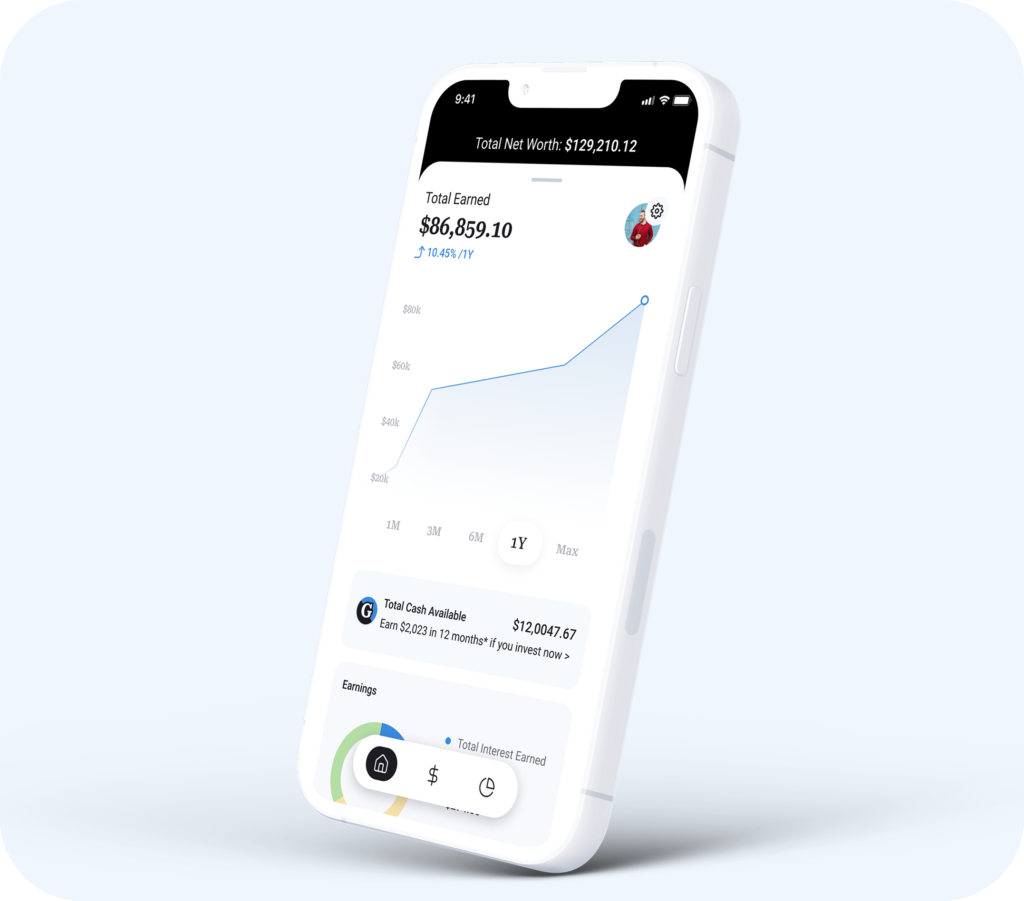

Alternative investing shouldn't be reserved for the wealthy. With Groundfloor, anyone can invest in short-term real estate loans that deliver steady returns without buying property or managing tenants.

It’s a simple, hands-off way to grow your money outside the stock market.

The path to private-market performance

Alternative investing shouldn't be reserved for the wealthy. With Groundfloor, anyone can invest in short-term real estate loans that deliver steady returns without buying property or managing tenants.

It’s a simple, hands-off way to grow your money outside the stock market.

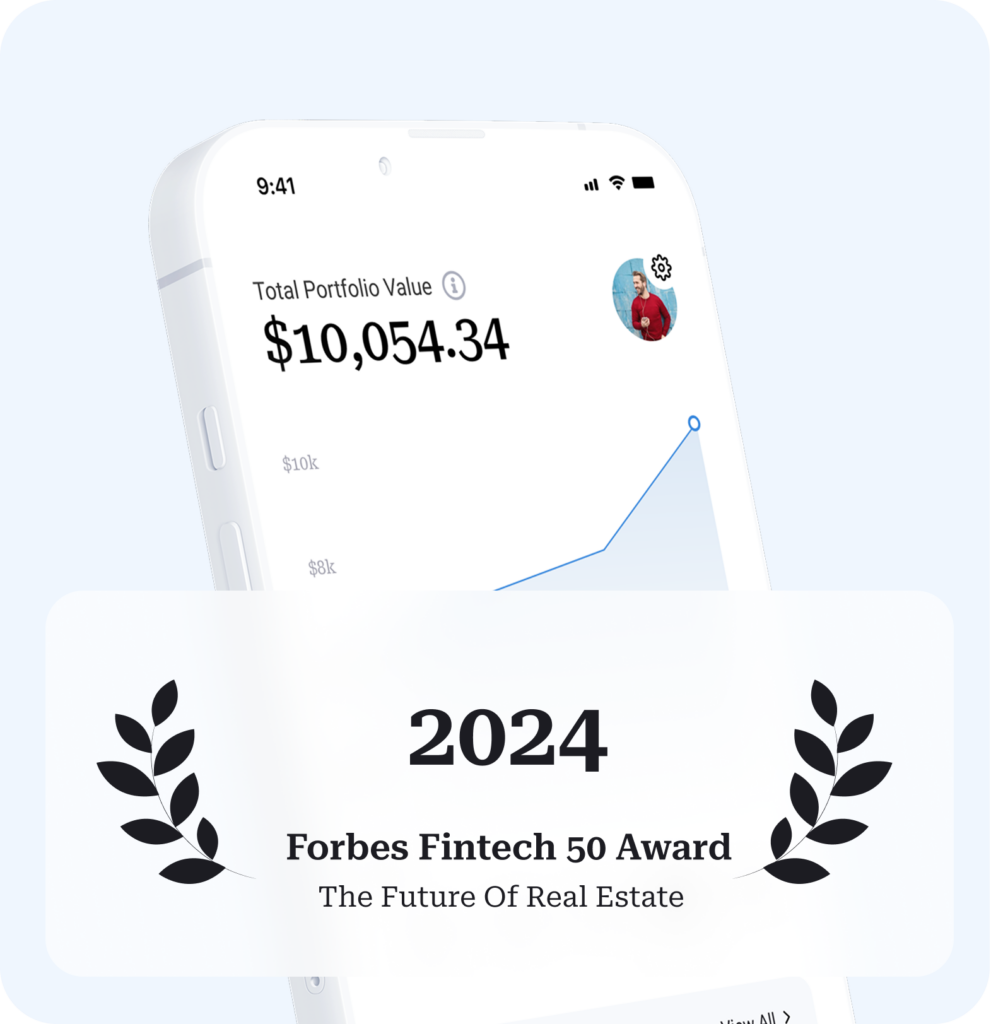

Recognized for

Innovation & Growth

Recognized for Innovation & Growth

*Rates shown as of Dec 2025 and may adjust monthly based on market conditions. Notes pay interest at maturity. All investments involve risk.

Groundfloor Notes

Notes are short-term investments with predictable returns and set repayment dates. With low minimums, Notes offer fixed 1-mo, 3-mo and 12 month terms.

You choose the term that fits your strategy and receive consistent income with no market exposure.

- 5 - 8.5%* returns

- Terms ranging from 1-mo, 3-mo, or 12-months

- Portfolio backed by diversified real estate loans

Notes are short-term investments with predictable returns and set repayment dates. With low minimums, Notes offer fixed 1-mo, 3-mo and 12 month terms. You choose the term that fits your strategy and receive consistent income with no market exposure.

- 5 - 8.5%* returns

-

Notes offer 1-mo, 3-mo,

or 12-month terms - Portfolio backed by diversified real estate loans

Groundfloor Notes

*Rates shown as of Dec 2025 and may adjust monthly based on market conditions. Notes pay interest at maturity. All investments involve risk.

Flywheel Portfolio

*Rates shown as of Dec 2025 and may adjust monthly based on market conditions. Notes pay interest at maturity. All investments involve risk.

Flywheel diversifies your investment across a mix of real, asset-backed opportunities, helping reduce single-asset risk and support steady, long-term growth.

- Instant diversification across assets, timelines, and geographies

- Consistent, long-term strategy that adjusts as assets repay

- Optional auto-reinvesting to help your portfolio compound over time

With our $10 minimum, Loans give you full control over where your money goes. You fund specific real estate renovations based on term length, location, and risk profile.

- Works for both beginners and seasoned investors

- Detailed borrower and property information

- Track progress with real-time updates

- Select from loans featuring interest rates ranging from 5% to 15%*

Loans

*Rates shown as of Dec 2025 and may adjust monthly based on market conditions. Notes pay interest at maturity. All investments involve risk.

Flywheel Portfolio

Flywheel diversifies your investment across a mix of real, asset-backed opportunities, helping reduce single-asset risk and support steady, long-term growth.

- Instant diversification across assets, timelines, and geographies

- Consistent, long-term strategy that adjusts as assets repay

- Optional auto-reinvesting to help your portfolio compound over time

*Rates cited are based on terms of underlying loan agreements with borrowers, and are subject to risk of loss, not guaranteed.

Loans

Want to choose where your money goes? Our Loans let you hand-pick individual real estate projects. With our $10 minimum, Loans give you full control over where your money goes. You fund specific real estate renovations based on term length, location, and risk profile.

- Works for both beginners and seasoned investors

- Detailed borrower and property information

- Track progress with real-time updates

- Select from loans featuring interest rates ranging from 5% to 15%*

How Groundfloor Investing works

1

Fund Real Estate Projects

Your investment goes directly into property-backed loans.

2

Earn predictable interest

As borrowers repay, principal and interest are returned to you.

3

Get paid or reinvest

Withdraw earnings or reinvest them in new projects to grow faster.

Why Groundfloor Is Different

Groundfloor gives everyday investors a clearer, more controlled way into private-market real estate—built on transparency, tangible assets, and a decade of proven performance.

Invest in Properties

Without Owning

Earn through real estate lending, not property management or market timing. Returns come from interest on short-term, secured loans.

Backed by Real

Verified Collateral

Every Groundfloor investment is secured by real property—not a token or fund abstraction. This tangible collateral adds protection when markets shift.

Designed To Perform

Through Market Cycles

We’ve navigated rate hikes, inflation, market swings, and a pandemic. With realized losses under 1.5%, our disciplined lending speaks for itself.

Join the Community

Groundfloor makes it easy for anyone to invest in private-market real estate and earn steady, reliable returns. Since 2013, more than 250,000 investors have chosen a smarter way to grow their money.

Join the Community

Groundfloor makes it easy for anyone to invest in private-market real estate and earn steady, reliable returns. Since 2013, more than 250,000 investors have chosen a smarter way to grow their money.

Frequently Asked Questions

How does Groundfloor work?

Groundfloor lets you invest in short-term real estate loans individually or through our diversified Flywheel Portfolio. You fund loans, and get repaid as borrowers repay.

Are there any fees to invest on Groundfloor?

There are no fees to invest in Loans or Notes. However, each batch of the Flywheel Portfolio has its own respective fees attached.

You can find more information here.

How does Groundfloor compare to other platforms?

We originate our own real estate loans, so you invest directly in short-term, asset-backed debt for faster repayments and more control.

What are the risks of investing in Groundfloor?

All investments carry risk. Groundfloor provides full loan details so you can invest smartly. Returns aren’t guaranteed, and investments aren’t insured.

How much do I need to invest?

You can start investing with as little as $100 on Groundfloor, making it accessible for most budgets. Some options, like Notes, may have higher minimums.