Spread the Word: Earn $50 for Every Referral When They Invest $100.

Invest in Your community

- High-Yield, Short-Term Investments

- Consistent cash flow

- Secured by Real Property, with Intrinsic Value

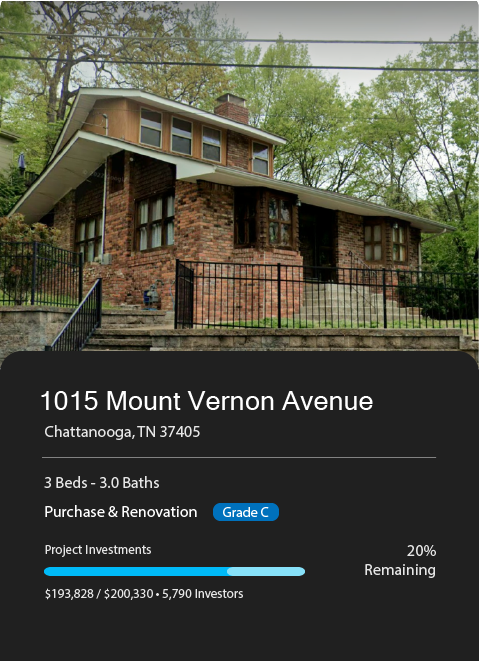

Projects

Build your portfolio, Backed By Data

Discover, analyze, and invest in real estate projects financed by Groundfloor.

Get Started

Real Estate:

Safe, Stable, Recession Proof

- $10 minimum to start

- Backed by real estate

- Simple and easy to use

- 8%–15% expected returns

Groundfloor is a unique financial platform for individual investors that allows non-accredited and accredited investors alike to participate directly in real estate renovation loans on a fractional basis. You can view some of our recently repaid investments below.

Returns

Minimal Concentration Risk

Continuously diversify across a range of investments with our Investment Wizard.

by SEC

Liquidity

- List Item #1

- List Item #1

- List Item #1

- List Item #1

- List Item #1

Testimonials

See What Our Clients Have To Say

Getting Started Is Easy

How It Works

Investing With Groundfloor

- 1) Create An Account

- 2) Link Bank

- 3) Start Investing

Creating an account to invest on Groundfloor is simple. Click on the “Get Started” button above and follow the user-friendly registration steps. You’ll provide essential information, like your email address, password, and personal details.

Once your account is set up, you’ll have access to a platform that empowers you to explore and invest in fractional real estate investments to help you grow your wealth. Take the first step toward financial freedom by creating your Groundfloor account today.

Once your bank’s linked, you’re all set to dive into the investing action on our platform! With your account synced up, you can easily jump into exploring the array of exciting real estate opportunities we have waiting for you.

Whether you’re a seasoned investor or just starting out, our platform provides the tools and support you need to make informed decisions and maximize your returns.

Start Earning Passive Income

Easily earn a consistent stream of passive income with Groundfloor. It’s never been easier. Start investing with as little as $10 on the platform.

With Groundfloor’s automatic investing, your investments are automatically invested and reinvested across a wide array of available loans. So sit back and relax with this true set-it-and-forget-it model.

Frequently Asked Questions

You've Got Questions

We've got answers

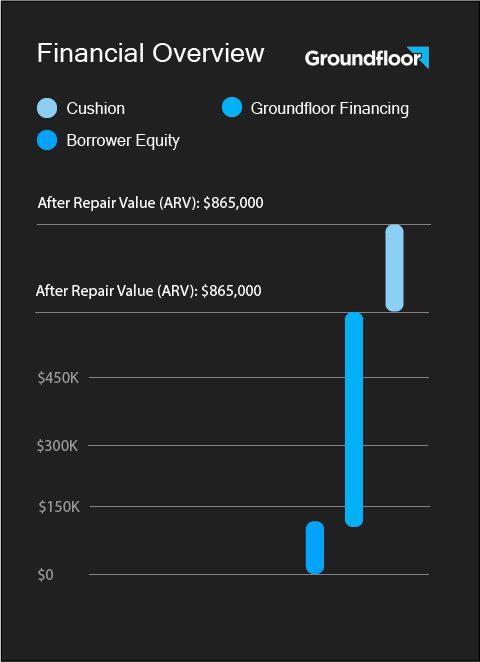

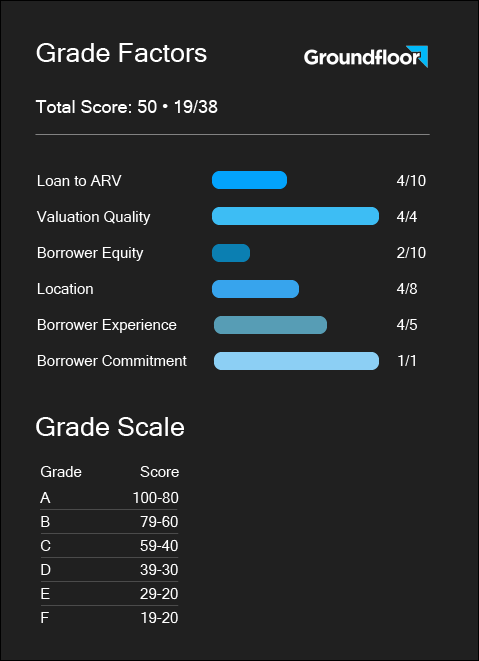

It all starts with the borrower. A real estate investor, who we call a borrower, secures a loan through Groundfloor rather than a traditional bank or a hard money lender to finance a residential real estate project. That borrower submits a loan application and we review and underwrite the loan using our loan grading engine. After review, the loan is assigned a loan Grade A through G and a corresponding rate where Grade A loans are the least risky, with the lowest rate of return and Grade G loans are most risky, with the highest rate of return. Grade A loans generally offer returns of 5.5% and Grade G loans generally offer returns of 26% with each letter grade offering a rate in that in range.

Our Borrower Services Team works with the borrower to tailor the loan to meet the needs of the project. The loan is then underwritten and assigned a grade and interest rate. We have filed an offering circular with the Securities Exchange Commission (SEC) through which we sell securities. The proceeds of these securities and the performance of these securities are tied to the individual loans we decide to originate. If we decide to put a loan up for funding, we amend our offering circular with the details of that loan. When that amendment is qualified, the loan may be taken live for investment. “Qualification” by the SEC is not an endorsement of our investments, and no government or agency has passed on the merits of our offering.

You can browse the summary view of loans funding on our site or view more information on each loan’s detail page. You decide when, how much, and where to invest. Investing is simple and efficient. You fund your Groundfloor Invest Account in any amount you choose and can invest after your funds post in 4 to 5 business days.

Once a loan is fully funded, a closing is initiated with the borrower. The loan closes, the borrower draws money according to a schedule, and completes the renovation or rehab project. The property is then listed, sells, and eventually closes. At closing the borrower repays investors via Groundfloor. A lump sum of principal invested plus interest earned is deposited into your Groundfloor Investor Account. The balance in your Groundfloor Investor Account can be withdrawn or reinvested in other projects.

For a more detailed overview of how Groundfloor calculates your investment return, please see our blog post on the subject.

With a minimum initial investment of $10, Groundfloor provides you a low barrier to entry, easy path to diversification, and puts you in a first-lien position.

Don’t let stock market volatility hold you back from investing. Real estate investing is a historically stable asset class and not impacted by geopolitical views and corporate earnings reports. Groundfloor also reports historic 10% returns.

Accredited and non-accredited investors can join Groundfloor. With lower minimums, shorter terms, and no fund lock-ups or manager-controlled payouts, Groundfloor optimizes your alternative investments.

Data as of July 2023. Sources: Investopedia; Macrotrends; Bankrate.

Funded by Groundfloor

Transforming Communities

One House At A time